Buying a property is one of the biggest purchases you’ll ever make.

It’s a stressful, time-consuming and overwhelming experience. Most people don’t know where to start.

There’s also never a perfect time to buy with property prices rising.

Getting yourself prepped is always the best move, from understanding the process and useful tips for when you’re ready to make that jump.

1. Get yourself a first-time buyer mortgage guide

There are many property guides, but our favourite is the Martin Lewis MoneySavingExpert First Time Buyers’ Mortgage Guide.

It gets updated every year and covers everything you need to know to boost your chances of getting on that property ladder.

The guide covers schemes such as Help to Buy and Lifetime ISAs that can help you save up for a deposit. It also provides details on shared ownerships, which are more affordable than a full mortgage.

2. No need to go broke for a broker

A broker is a mortgage adviser. Brokers filter through all the deals in the market to find the best mortgage for you.

They charge from £500 to £1,000. Websites such as unbiased and vouched for help with finding brokers.

Some free brokers such as London & County are just as good. They get paid through a commission, typically 0.35%, from the mortgage lender.

Brokers will check your affordability, so have your paperwork ready beforehand:

- Proof of your deposit

- Proof of ID

- 3 months of payslips

- 3 months of bank statements

- Letter of employment, your P60 or proof of income such as annual tax returns and profit and loss statements if you’re self-employed

3. Keep an eye on stamp duty and interest rates

As a first-time buyer in England, you currently don’t have to pay stamp duty for properties up to £425,000. A stamp duty of 5% is paid on properties from £425,001 to £625,000.

While stamp duty rates have dropped, interest rates have been rising. All these need to be considered, but your broker can help with all of that.

4. Narrow down the areas you’re interested in

Next, is finding where you want to live.

You’ll need to go offline and visit different places.

Factors such as being close to family or friends, being within a reasonable commute to work and areas within your budget will all play a part.

Once you’ve ventured out, focus on 2-3 areas to make your search more manageable.

5. Go on the property hunt

The most popular UK websites to look for properties are Rightmove, Zoopla, Boomin, OnTheMarket and Home.

Set up daily alerts to be notified as soon as a place that meets your criteria comes on the market.

It’s worth checking how long properties have been on sale by looking at the date they were posted online. This can help with negotiations as the longer a property has been on the market, the more a seller may be willing to accept lower offers to sell quickly.

A good trick is to install property trackers on your web browser. When you view property listings, they will show historical information, such as price changes.

6. Come armed with questions in your property viewings

To know what you’re getting yourself into, come ready with questions.

You, of course, don’t want to piss off the estate agent or the seller. But if you ask your questions politely, they’ll understand that you’re serious and mean business.

7. Check and ask for the below in your property viewings

- Find out why the seller is selling now (to make sure there are no big red flags about why the property is on the market).

- Check how old the building is (to know how much maintenance may be required).

- Check the outside walls (for any damage or cracks).

- Check if the property is a leasehold or freehold. If you’re buying a flat, it’s likely to be a leasehold. This means you own the property, not the building or land it’s on, that’s owned by a property management company. Houses, meanwhile, are usually freehold, meaning you own the property and land. But it’s always worth double-checking, just in case.

- Check how long is left on the lease for flats and leasehold properties. Look for properties with long leases, ideally 100 years plus. Leases with 80 years left and under can be a nightmare to extend and can cost up to £20k. When you’re looking to sell, buyers won’t be keen to take on that extra cost of extending the lease.

- Ask how much ground rent and service charges are for flats and leasehold properties. These are usually paid monthly to the property management company. Make sure you can afford this on top of your mortgage and bills.

- For flats and leasehold properties, you can also ask who the leaseholder is. You can check how the property management company is to deal with and if they’ve had any major complaints against them via the leaseholder advisory website. Here’s a guide to understanding leases.

- Check the ceilings and inside walls for any dampness, leakages or cracks.

- Check the radiators for any leaks or rust.

- Check and ask if any renovations have been done (although, at times, it’s easy to tell).

- Ask if parking permits are required (if you plan to move in with a car).

- Check that the property has storage (ideally, you want somewhere you can grow into for a few years).

- Ask how old the boiler is (there’s nothing worse than an old boiler breaking down when you’ve just moved in during the winter months).

- Flick switches to check the electrics are working.

- Ask if any electrical and gas installation reports will be made available once you put in an offer (to check their condition before you buy).

- Open doors and windows to check noise levels (if you’re looking for a quiet life).

- Check your phone to see if you can get a signal (as some properties have terrible reception).

- Take photos (but first, ask if that’s allowed. If you’re viewing many properties, this helps you keep track. Otherwise, save the property website photos).

8. Stalk the area

Find out about the neighbourhood if you’re new to the area.

Turn up a few minutes before your property viewing to scope out the neighbourhood or stay behind afterwards.

Get an idea of how close or far shops and train stations are, and what the people in the area are like. See if you can imagine yourself living there. For a full stake-out:

- Go to the land registry (to check who the previous owners were, how much they paid for the property, and average sale prices in the area. This can help when negotiating prices)

- Check the local council for upcoming developments in the area (which could help increase the value of your property in the future)

- Check crime rates in the area

- Check school performances in the area (if planning for kids)

- Check the flood risk of the area

- Check the council tax band of the property (A is the cheapest council tax band, and D is the most expensive. A higher council tax band will need to be factored in with your other bills)

9. Bring in a property solicitor (or conveyancer)

You’ve found a place you like and can afford, made an offer, and they’ve accepted!

But let’s not celebrate just yet. Now it’s time to bring in a property solicitor.

Your broker may have recommended one; otherwise, research some from the start by getting recommendations from friends, family or through websites.

Your property solicitor or conveyancer, as they’re called, is responsible for all your property’s legal checks and contracts. These can take 1-3 months and cost up to £1,000.

Make sure you still have somewhere to live while waiting for the exchange of contracts to complete before you can move in.

This guide from Which breaks down everything you need to know about the legal process when buying a property. Compare and convey also give estimates on legal fees.

10. Get a property surveyor

Property surveyors are experts that inspect the property before you buy it. They flag any issues with the property, such as structural problems, and any repairs to be aware of.

A home survey typically costs between £400 and £1,500, depending on the property size. Getting one is recommended because you want to know what you’re paying for is in good condition.

11. Prepare for moving day

If things are progressing well, you’ll be planning your moving day.

It’s usually good to visit the property one last time before moving in, to take any measurements and have a visual of the furniture that can fit.

To furnish your new place, you may have furniture from where you were renting.

You can also ask family and friends if they have any spare furniture to give away.

Check with the seller if there’s anything they’ll be willing to leave behind, such as the fridge, washing machine, cooker, curtains and old furniture.

Freebies and anything that can help you save money will be your friend at this point.

Websites like Freecycle and Gumtree offer free furniture people want to give away.

If you’re trying to get rid of things you don’t want to take to your new place, you can donate them to charities such as the British Foundation, which collects old furniture for free.

12. Budget, budget and budget

Throughout the process, stay close to your budget.

Buying a property isn’t a linear process as properties may fall through, and you may have to start over each time.

There will be inevitable things you couldn’t anticipate, so keep a spreadsheet to track all your expenses.

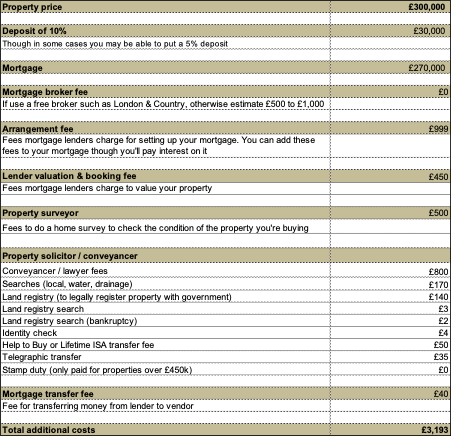

Here’s an example of costs you can expect when buying a property of £300,000:

The process of buying a property is a marathon, not a sprint.

Pace yourself by approaching everything, step by step.

We have friends who saved for 2, 4 or even 6 years before they got themselves on the property ladder.

It’s also not for everyone. Decide if it’s right for you.

If it is, that day you get the keys to your own place, you’ll look back knowing it was all worth it.

What an insightful read. This is essential info for anyone wanting to get onto the property ladder!

Thank you for your feedback!